Dawn of Decentralized Science

Issue #2: Psychedelic Intellectual Property and Funding

Psychedelics are on course to become the first significant breakthrough in mental healthcare since antidepressants were introduced in 1987. They offer a new way of thinking about mental health, but as an entire industry is built around a class of compounds known to expand consciousness, some are wondering whether they might provide a canvas for more expansive business models.

Concurrent with renewed interest in psychedelic research, a growing number of scientists and entrepreneurs are using web3 tools, like smart contracts, tokens, and distributed ledgers, in an attempt to improve modern science. Collectively, this work has become known as decentralized science, or the ‘DeSci’ movement.

Similar to how web3 is disrupting other industries, where earlier models of centralized ownership are being challenged by decentralized, shared ownership, DeSci aims to find new approaches to scientific funding, reduce reliance on intermediaries and increase collaboration across the field1.

This article explores how decentralized science might help plug gaps in the emerging psychedelic ecosystem, increase collaboration across the field, and, in doing so, ensure that its many diverse stakeholders are appropriately incentivized and remunerated.

Let’s dive in

DeSci lies at the intersection of two broader trends. The first is an effort from scientific communities to change how research is funded and knowledge is shared. The second is an effort from web3 communities to shift ownership and value away from centralized intermediaries.

There are two related areas, if applied in the right way, in which DeSci can provide valuable tools to the psychedelic industry:

Distributed ownership of patents and intellectual property

Alternative funding models for early stage research

How DeSci can improve our approach to psychedelic patents

Patents provide an incentive for people to innovate without the fear that someone will copy their idea. They’re helpful in protecting resource allocation, and, when used responsibly, can help facilitate strategic cooperation among different individuals and organizations. Yet all too often they are used for profit maximization and resource extraction. For example, Johnson & Johnson has been accused of price gouging when it announced that its ketamine-derived depression treatment, Spravato, would be priced at $590 for a 56mg dose when the average cost for a 50mg dose of generic ketamine is $11.992.

In his paper ‘Can We Have a Psychedelic Patent System?’ Graham Pechenik explains that in the emergent psychedelic industry we have the opportunity to reimagine our relationship with them—and choose to use patents as tools to facilitate and support ethical ways of doing business. ‘Our choice will shape how the psychedelics ecosystem develops, with potentially profound economic, social, and cultural implications’3.

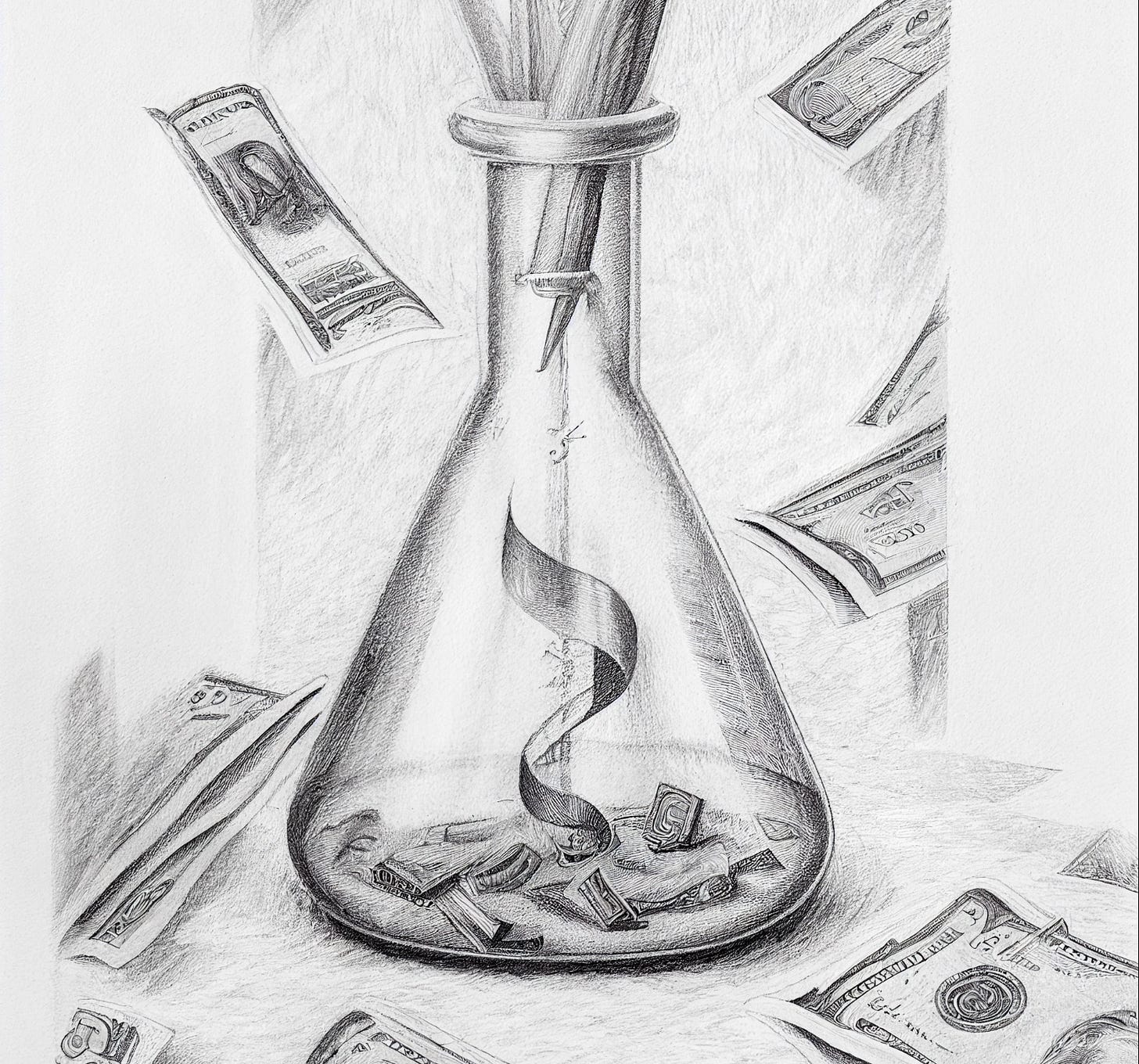

IP is a highly illiquid, bureaucratic and opaque asset class that too often restricts collaboration. With token economics and adjacent technologies like smart contracts and DAOs we can enable communities to be the new “shareholders” of scientific knowledge creating new incentive structures that motivate researchers and sources of capital to work in fundamentally different ways.

To understand how, let’s quickly rehash how NFTs create value.

Markets can’t operate without clear property rights. Before you can buy something, it has to be clear who has the right to sell it. Once someone buys it, we need to be able to transfer ownership from the seller to the buyer. This is fairly straightforward when buying a banana at the grocery store, but more complicated with digital or intellectual value.

Non fungible tokens (NFTs) solve this problem by giving parties something they can agree represents ownership. In doing so, they make it possible to build markets around new types of transactions — buying and selling products that could never be sold before, or enabling transactions to happen in new, more efficient ways.

Now imagine that the property in consideration is not a banana, but intellectual property behind scientific research.

What if there was a way to tether that intellectual property to NFTs and what would be the implications? For example, each inventor's patent could be minted as an NFT, and these NFTs would be joined together to form a commercial IP portfolio and minted as a compounded NFT. Each contributor would automatically get their agreed share of royalties whenever the licensing revenue is generated without tracking them down.

This is exactly what Tyler and Paul are working on at Molecule.

Through a clever combination of non fungible tokens (NFTs), decentralized autonomous organizations (DAOs) and automatic market makers (AMMs), Molecule allows novel therapeutics to be funded and governed by open communities and decentralized finance, as opposed to single centralized entities and corporations.

In a nutshell, with Molecule researchers can offer different legal agreements for assets originating from their research and collect the funding they need. Investors can easily fund research and provide the funds instantly with native tokens, and, in a regenerative model, the value created by the assets can then be used to fund the creation of new research and clinical trials.

In many ways the work that Molecule is doing is providing the infrastructure and playbook for decentralized science communities globally. Many new DAOs, either directly or indirectly associated with Molecule, are beginning to leverage their IP NFT framework.

For example, in VitaDAO, Molecule’s longevity-focused DAO, the community operates like a venture fund and is organized into various working groups composed of scientists, investors, lawyers, among others to evaluate projects for funding. Community decisions are largely voted on using the DAO’s native $VITA token and much of the work takes place on a publicly accessible Discord.

VitaDAO has evaluated over 60 research proposals and financed almost two million dollars worth of research across 10 projects - traction they hope to replicate with PsyDAO, a new DAO incubated in the Molecule community that will look specifically into opportunities at the intersection of psychedelics and mental health.

VitaDAO is not the only group pioneering such a model. Founded by Aaron Wright and the team at Tribute Labs, BeakerDAO is a new collective supporting the expansion of decentralized science. Through research funding and IP management, BeakerDAO promotes open accessibility and decentralized market liquidity across the DeSci space. Still in very early days, the team is actively looking for builders and researchers, so if this sounds like you, please reach out and we’re happy to make an introduction.

With NFTs we can begin to rethink intellectual property, who owns it, and how value can be transferred back to them. This is important in the context of all scientific research, but especially when applied to psychedelic science, where the origins of new ideas are particularly obfuscated by thousands of years of prior indigenous practice and decades of underground use that is now for the first time recognized as commercially viable.

How DeSci can improve our approach to funding psychedelic research

Applying for a patent and trademark is a time-consuming, costly and lengthy process.

Despite the $236 million of dollars that have entered the psychedelic industry between July 2021 and 2022, the majority of promising early-stage psychedelic research still lacks funding and access4.

In the US, this is due in large part to their classification as Schedule 1 drugs with no FDA-approved medical use. This is also due to a broader challenge within the scientific community of misaligned incentives behind research and intermediaries who control what kind of work receives funding.

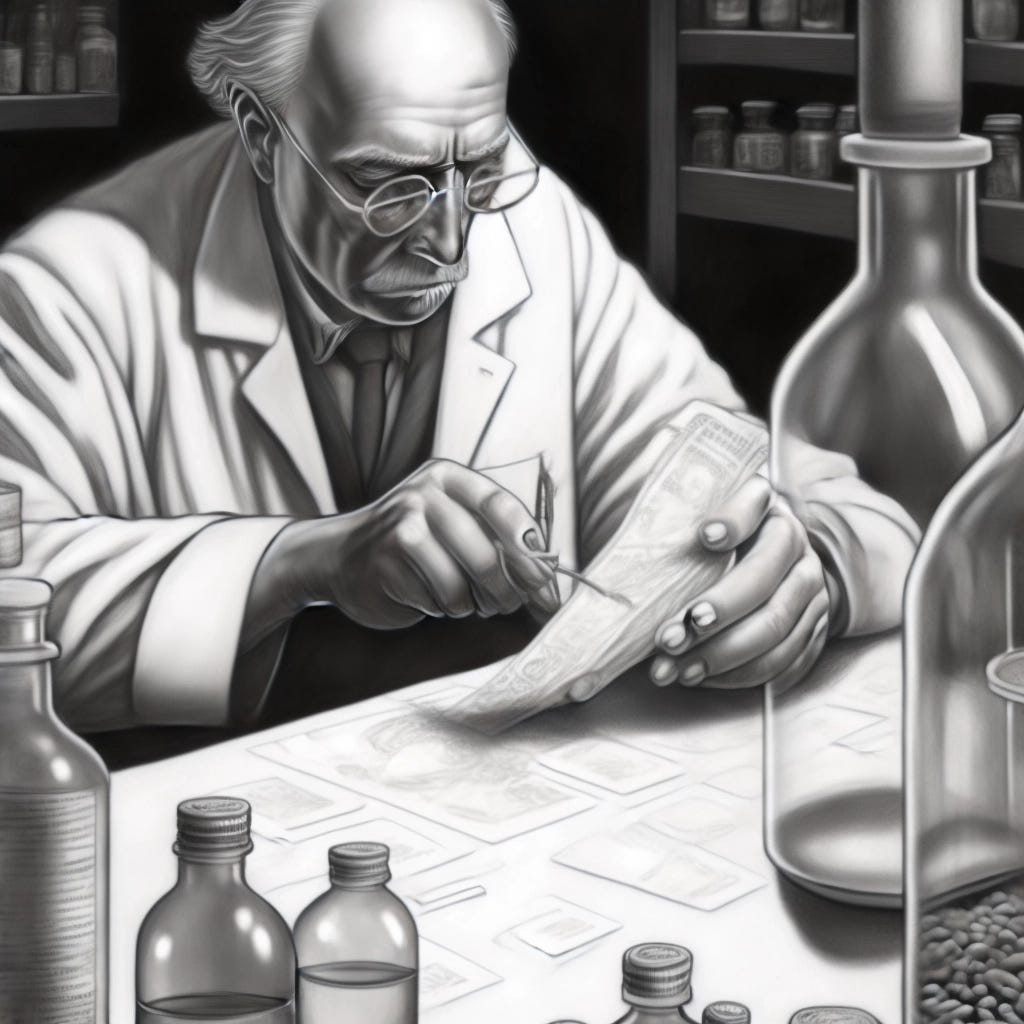

Historically, the idea of being a ‘career scientist’ wasn’t really a viable option until after the second world war, and in many ways the economics of the profession haven’t materially changed over the past 80 years.

In the US, funding bodies like NIH control the majority of the way that scientific research is funded - who can publish, which topics are chosen and what kind of work gets selected. For example, a postdoc hoping for a tenure position is effectively at the mercy of a handful of large publishing houses (Science, Cell, Nature) who are able to validate and distribute their research. But even if their work is selected, researchers then need to pay up to $10k to have their work published. So rather than rewarding scientists for novel research, the current economics currently move in the opposite direction.

We need to find ways to bring the economic value back to the people who are actually producing the work.

With web3 native tools, we can begin to imagine a world where researchers are able to self fund their own academic pursuits, or at the very least find more adaptive channels of funding that do not rely on intermediaries or a small subset of philanthropists.

In a sense this is exactly what the creator economy sets out to do, and the art and music industry has embraced NFTs by storm. With DeSci we can use the same philosophy and technology to empower scientists by providing researchers the autonomy and ownership to be able to explore opportunities in science that often may not adhere to the interests of large institutional players.

According to Savva Kerdemelidis one such golden opportunity that is frequently being missed due to a lack of financial incentives is repurposing old inexpensive generic drugs for new indications.

Savva is founder of Crowd Funded Cures, a web3 launch pad that is seeking to decentralize the funding of unmonopolizable therapeutics like nutraceuticals, cannabinoids, and psychedelics leveraging a pay-for-success financial model.

Still in early stages, CFC will ultimately help interested communities identify, fund and generate clinically meaningful data using randomized control trials. That data can then be incorporated into an NFT and be made available on an NFT marketplace.

Imagine a truly decentralized OpenSea, but instead of bored apes, clinically valuable scientific research is exchanged.

What could this look like in practice?

Ravi Das is one of the psychopharmacologists behind what is planned to be the largest psychedelic neuroscience study in history. Conducted at a lab at Imperial College London, Das and his colleagues’ study will consist of taking fMRI scans of over 150 people to record their brain activity before, during, and after using DMT.

Das estimates that it will cost well over a million pounds, and in order to secure grant funding they first need to demonstrate proof of concept. A common catch 22, they need funding to start the research, and preliminary research to find the funding.

‘“We have had several offers from venture capitalists, drug companies and private equity to fund part of the study; all of which we've turned down because the most important thing to us is maintaining scientific impartiality and independence, while avoiding conflicts of interest,” he told Microdose.

What if there was a way for Das to secure his funding needs from aligned and mutually incentivized capital in a way that not only maintained but protected his team’s academic autonomy?

One answer might be decentralized science.

https://future.com/what-is-decentralized-science-aka-desci

https://www.webmd.com/drugs/2/drug-176955/spravato-nasal/details

https://maps.org/news/bulletin/can-we-have-a-psychedelic-patent-system/

https://news.crunchbase.com/health-wellness-biotech/psychedelics-drug-funding/